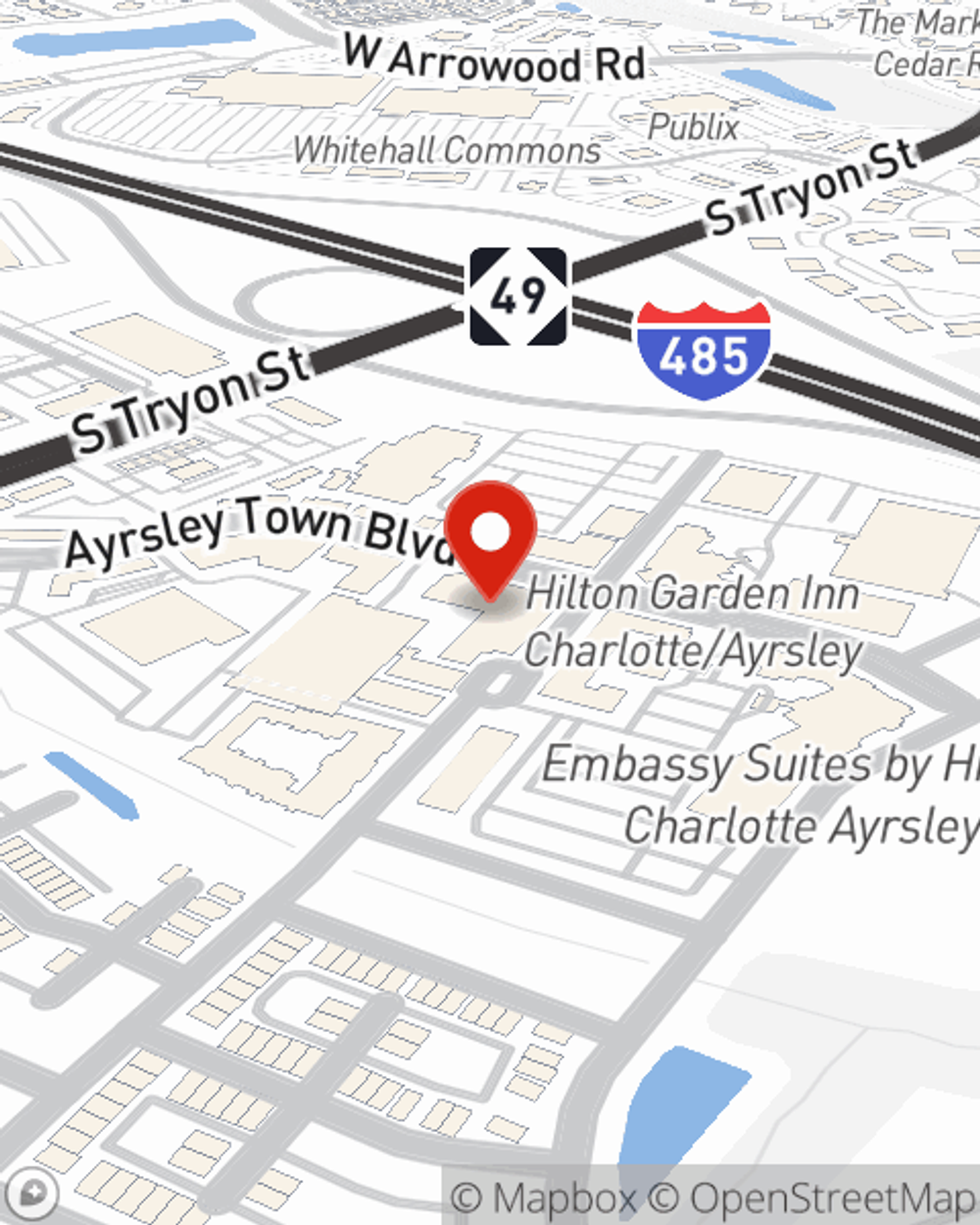

Renters Insurance in and around Charlotte

Charlotte renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Fort Mill, SC

- Denver, NC

- Huntersville, NC

- Steele Creek, NC

- Gastonia, NC

- Waxhaw, NC

- Mecklenburg County

- Union County

- Lake Norman

- Lake Wylie

- Clover, SC

- Mooresville, NC

Calling All Charlotte Renters!

Renting a home comes with plenty of worries. You want to make sure what you own is protected in the event of some unexpected damage or mishap. And you also need liability protection for friends or visitors who might stumble and fall on your property. State Farm Agent Megan Koterba is ready to help you prepare for potential mishaps with reliable coverage for your renters insurance needs. Such attentive service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Megan Koterba can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Charlotte renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Why Renters In Charlotte Choose State Farm

The unexpected happens. Unfortunately, the stuff in your rented home, such as a video game system, a tablet and a guitar, aren't immune to tornado or burglary. Your good neighbor, agent Megan Koterba, is ready to help you know your savings options and find the right insurance options to help keep your things protected.

It's never a bad idea to make sure you're prepared. Call or email State Farm agent Megan Koterba for help understanding coverage options for your rented home.

Have More Questions About Renters Insurance?

Call Megan at (704) 248-0309 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Megan Koterba

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.